Digital Onboarding

Artificial intelligence (AI) is transforming the insurance sector, benefiting both policyholders and insurers. AI-powered technology enables quick customer responses and round-the-clock communication, which are critical components of customer service in the insurance industry.

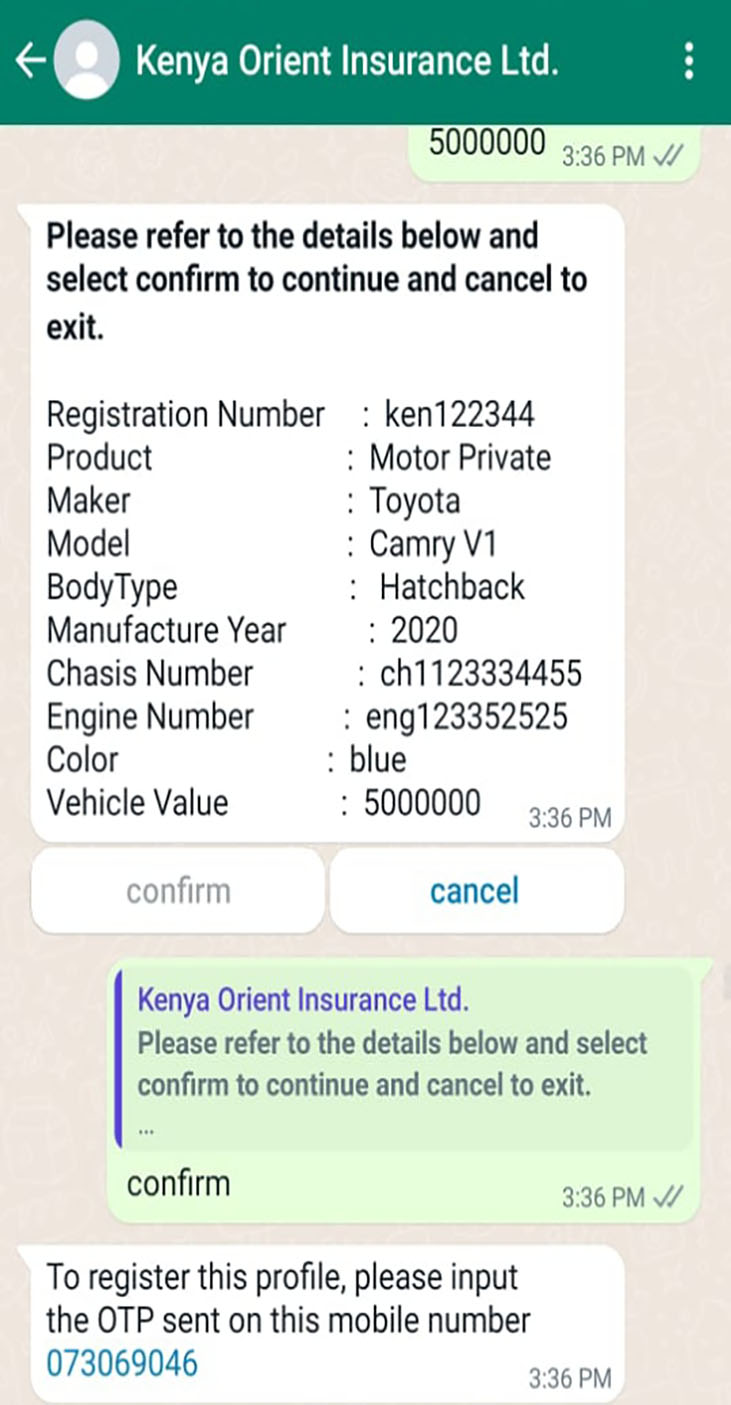

Accelerate customer acquisition by automating end-to-end processes for a simpler and faster onboarding experience with comprehensive eKYC while adhering to compliance standards.

Create a smooth omnichannel onboarding experience by employing AI and machine vision models that are optimised to complete the process in under three minutes!

Reduce new customer acquisition costs by using AI-powered remote account opening and eKYC.

Onboarding is seamless across languages and multiple digital channels such as WhatsApp, Facebook, Twitter , Web and mobile.

eKYC

AI and Machine vision models are optimized to create secure and frictionless customer journeys and complete eKYC in under 5 minutes with facial recognition, speech verification, and live video chat.

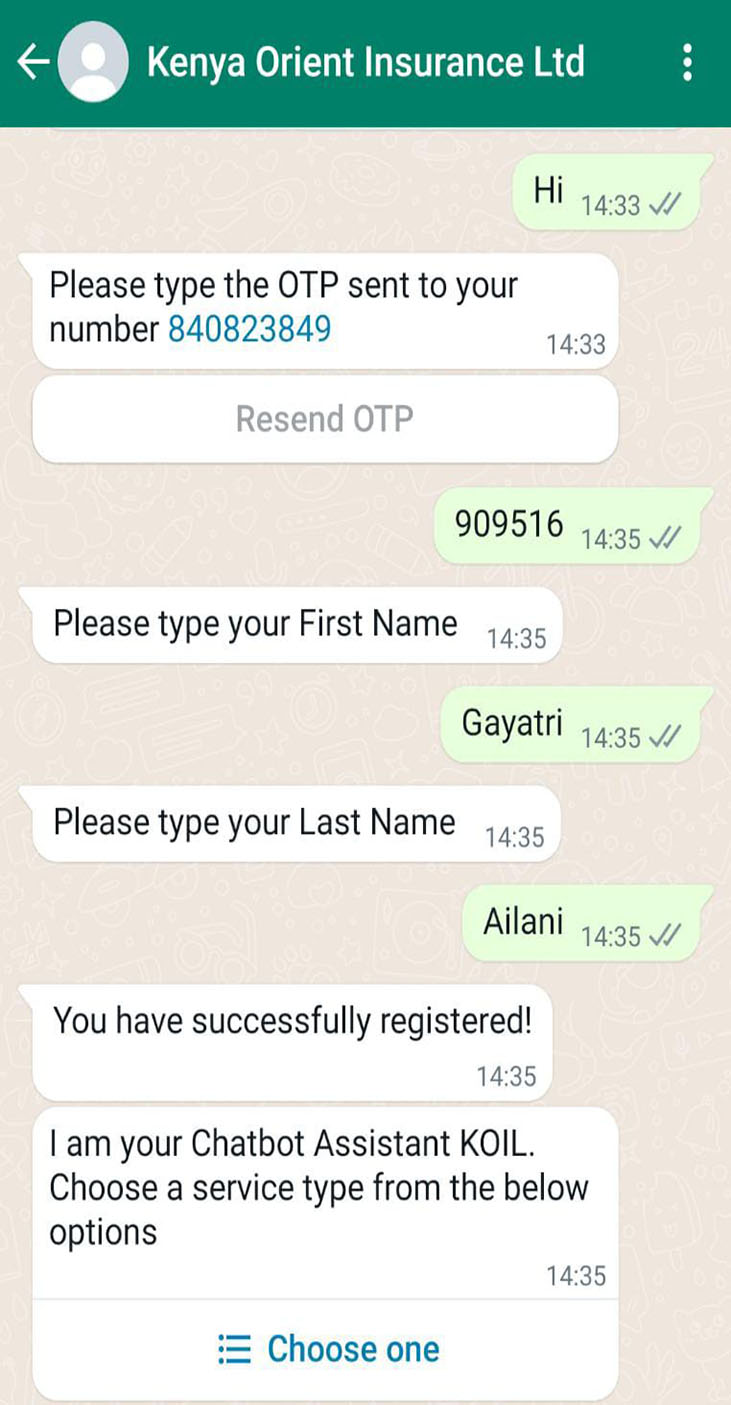

Muti-factor Authentication

Ensure Security via built in multi-factor user authentication in all transactions.

Document Upload & verification

Data & image extraction from IDs with quick system integrations for verifications.

Human Hand-off

Bring a human in the loop and directly interact with the customer through live video.

Frictionless new customer onboarding in less than 3 minutes!

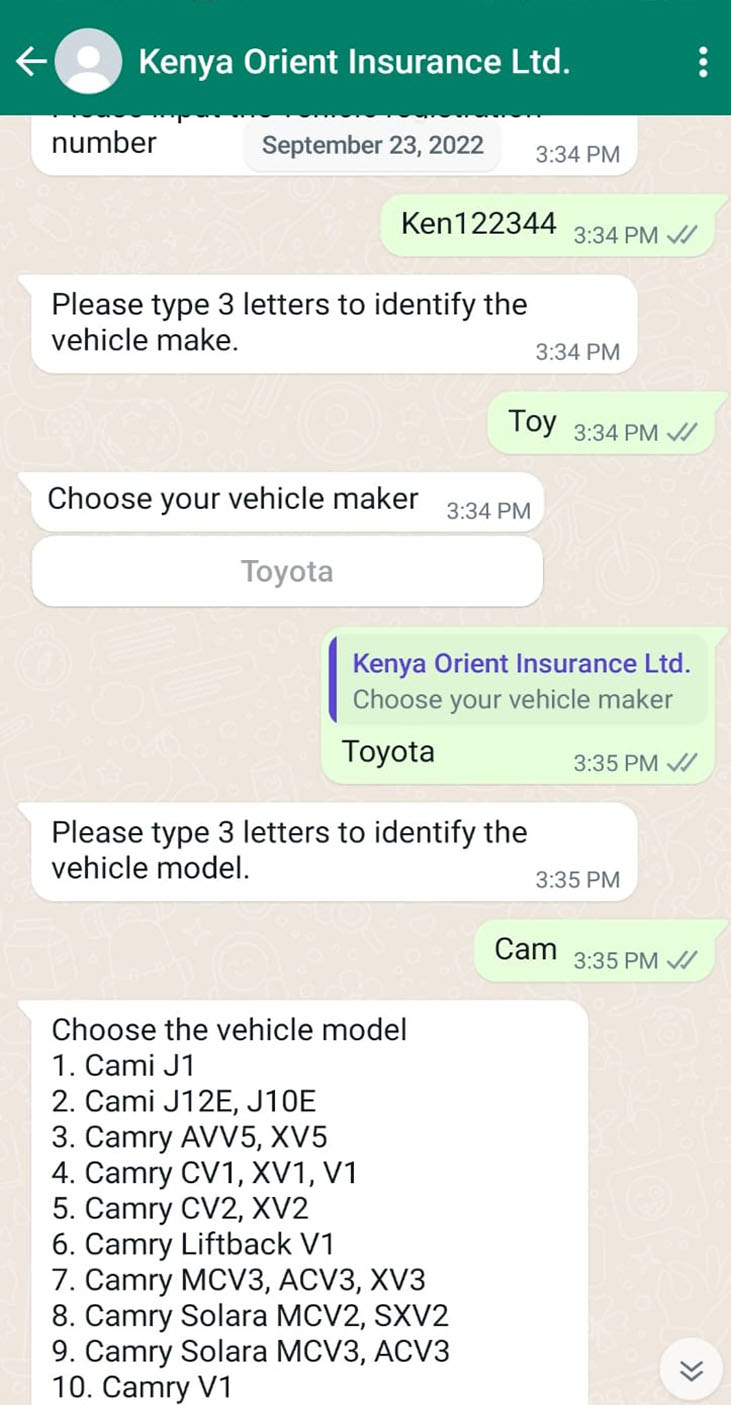

Leverage pre-built, multilingual NLP chatbot with frictionless & secure customer transactions to enhance your reach

Omni-channel & Multi-lingual

Widen customer base and expand reach in different locations with omnichannel multilingual chatbots for seamless onboarding and fully digital eKYC across channels including WhatsApp, Facebook, Web, and mobile.

Multi-level customer authentication

Multi-level user authentication including OTP/Pin, passwords, customer credentials, and primary data.

Secure Onboarding

AI and Machine vision models are optimized to create secure and frictionless customer journeys and complete eKYC in under 5 minutes

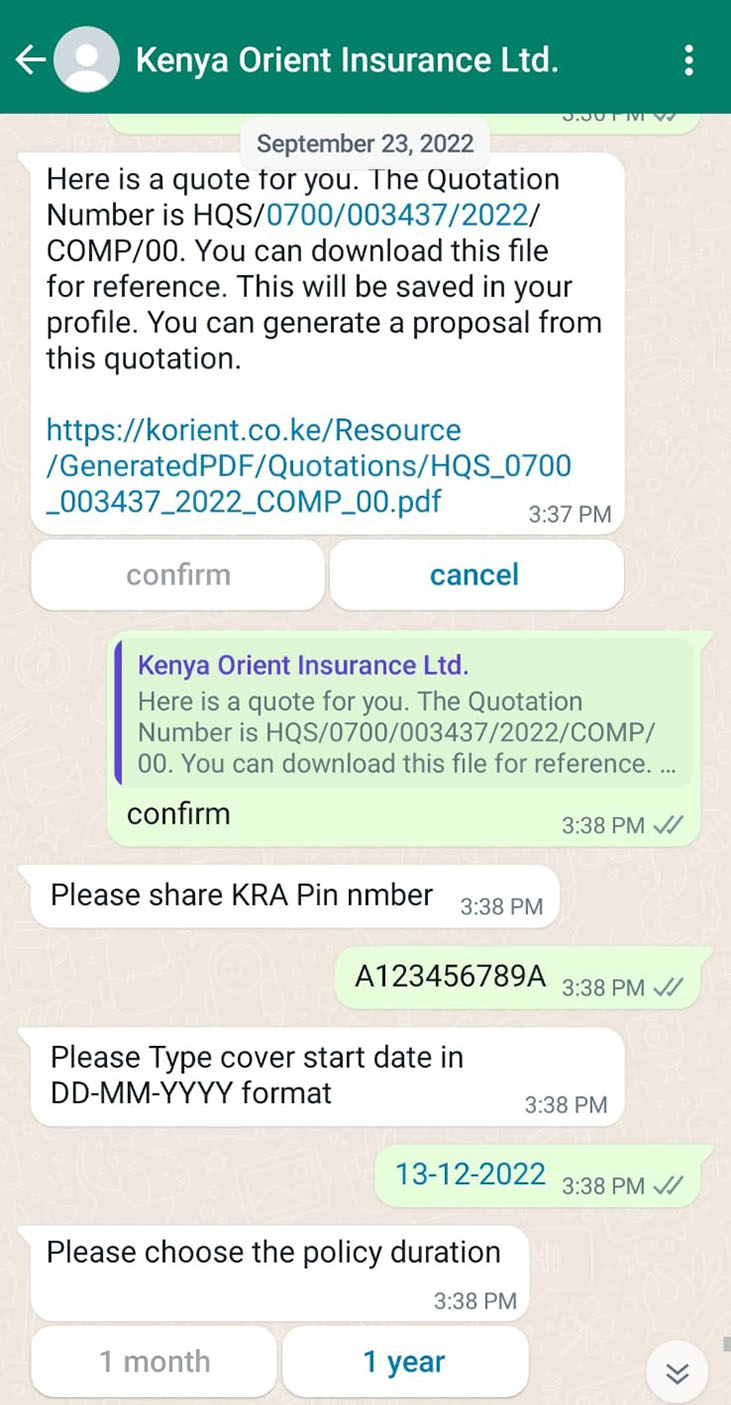

Document Upload & Data Extraction

Enable users to directly upload relevant documents like National IDs, Photo ID, Address proof, etc. as per compliance requirements.

Document Verification

Collect required documents, capture and analyze information using computer vision and OCR. Integrate with internal systems,verify and ensure compliance.

Face & Speech verification

Match extracted images to the user using live selfie/video upload with ASR for Speech verification.

Liveness Detection

Real-time face & voice matching with live video recording.

Human Hand-off

Agent Assist helps automate bot to agent handoff with AI to create personalized digital insurance services.

Frictionless, Embedded, Personalized, Secure Insurance

Customer profile data

eKYC with external validation

Product specific data collection

Instant policy issuance

Kick Start your Strategic journey towards AI-Powered Personalized Insurance