Use Clickstream based personalization to enhance digital banking sales

Are users of your website getting lost?

Does an excessive amount of information result in more abandonment?

Leverage InsureBuddy's intelligent recommendation engine to boost session income, lower churn, and bounce rates, and boost user conversion.

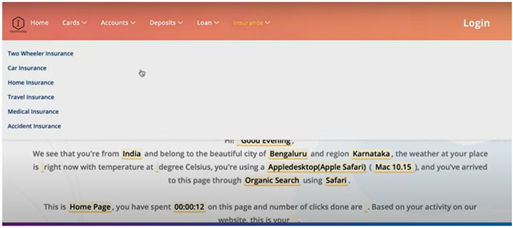

A. Personalise visits for Anonymous visitors

Analyze aggregate customer clickstream data with machine learning to identify behavioral patterns and make streaming recommendations across web, mobile, social media, and chatbots. Gather lead information for intelligent engagement through targeted digital campaigns.

For example, prospects visiting from an Android device between 1-2 pm on a working day from a corporate network in the CBD area who clicked on a medical insurance menu and spent more than 4 minutes could be interested in purchasing life insurance from InsureBuddy based on their city of residence/work.

B. Give relevant suggestions to returning visitors

Increase engagement opportunities by mapping user affinity and assisting returning users in picking up where they left off in order to reduce the time spent restarting the discovery experience. Prepare the page layout dynamically and change static content, such as banners, pop-ups, and so on, to display relevant products/pages based on previous visits.

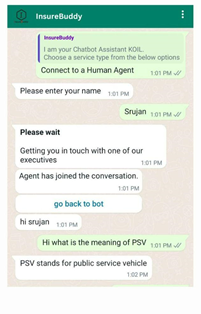

Create intelligent digital journeys based on customer personas and direct users to chatbots for specific questions, as well as offer in-chat recommendations and special offers.

use machine learning to predict the propensity to buy and recommend relevant offers and Calls to Action (CTA) to increase conversion.

For example: Show an offer of Insurebuddy health insurance coverage with add-on benefits that include 30% off on an annual health insurance coverage

C. Human in the Loop for superlative conversion

Auto triggers human handoff to bring human in the loop. Use skill-based routing along with sentiment/priority-based human handoffs to ensure prompt response at every opportunity.